The once seemingly unstoppable flow of lucrative contracts for international architects in Saudi Arabia appears to be slowing down significantly, marking the end of what industry insiders are calling a "feeding frenzy" that lasted for several years. Just 18 months ago, almost every major UK architectural practice was either establishing offices in the kingdom or deeply involved in masterplanning massive development projects as part of Crown Prince Mohammed bin Salman's ambitious Vision 2030 initiative.

The dramatic shift comes as low oil prices and overspending on mega-projects have forced Saudi Arabia to reassess its development pipeline. Projects like NEOM's several regions are reportedly being scaled back or having their timeframes adjusted, while others are undergoing comprehensive financial and strategic reviews. A recent Financial Times headline about the downturn in consultant hiring in Saudi Arabia declared "The Glory Days are Over," citing stuttering mega-projects throughout the country.

The slowdown became apparent during a flagship investment forum in Riyadh, where even UK Chancellor Rachel Reeves traveled to promote British business interests. However, a Saudi official at the same event candidly admitted, "We spent too much. We rushed at 100 miles an hour. We are now running deficits. We need to reprioritize." This statement reflects a broader recognition within the kingdom that the rapid pace of development was financially unsustainable.

Nearly all Saudi projects fall under Vision 2030, the crown prince's development program announced in 2016 to steer the country away from oil dependence toward tourism, hospitality, and real estate. The initiative is financed by the Public Investment Fund (PIF), Saudi Arabia's sovereign wealth fund, which remains heavily tied to oil revenues. Giant projects like NEOM, Qiddiya, Diriyah, AlUla, and Foster + Partners' plans for a 2-kilometer tower all depend on income from the nation's vast oil and gas reserves.

The current financial squeeze stems from recent price shocks in the petrochemicals sector due to oversupply and weak demand, creating cash-flow problems for the PIF. A senior individual at a public relations agency working in Saudi Arabia explains, "The projects controlled by the PIF rely on funds from the sale of hydrocarbons, and with the oil price under pressure, there is a squeeze on liquidity. The response can either be to slow projects or to reduce waste and overspending and keep projects on track. The PIF is looking at the latter approach."

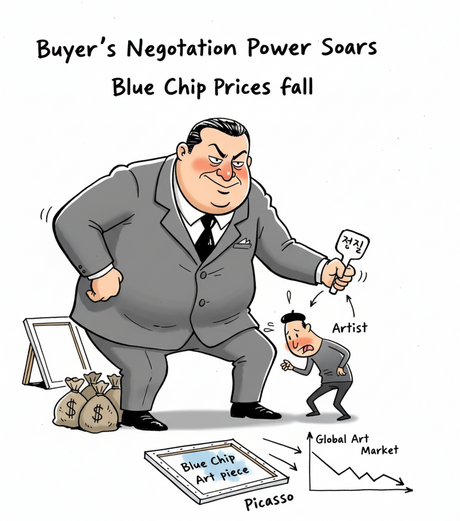

For architects, this recalibration means significantly tighter fees and more competitive bidding processes. "This year we have seen a lot more calculated tendering, which is now looking for return on investment and value," notes the same PR leader. While some view this as slowing investment, it's also being driven by increased options and more competitive pricing. An architect in a leadership position at a London-based practice confirms, "Saudi has been slowing down for months now. It's a recalibration of priorities away from crazy projects like NEOM toward sports and events venues like Qiddiya."

The impact on employment prospects for architects is becoming increasingly apparent. Lucy Cahill, director at London-based recruitment agency Bespoke Careers, reports that the employment pipeline feels "noticeably flatter than a year ago." She explains, "Around 18 months ago, we brought in a dedicated consultant to focus solely on that market. While the scale and ambition of projects were compelling, the pace of recruitment has proven more volatile and unpredictable than expected. The volume feels noticeably reduced compared to the peak activity we saw a year or so ago."

Paul Chappell from 9B Careers offers similar observations while noting the situation isn't as dramatic as the 2008 global financial crash. "We have seen a few candidates who have been made redundant over there, but certainly nothing dramatic," he tells industry publications. However, business confidence took another hit when the International Olympic Committee recently canceled a 12-year deal with Saudi Arabia to host the Esports Games from 2027.

The rise of artificial intelligence is adding another layer of complexity to the consulting landscape. StudioDS founder and director Diba Salam notes that AI is enabling the kingdom to move megaprojects from vision to delivery without relying as heavily on external consultancy services. "Saudi clients are increasingly questioning the value of expensive external advice. Many are now building internal teams, leveraging AI to deliver faster and cheaper outcomes," she explains. "Many projects are leaping straight from concept to construction, bypassing spatial and developed design stages essential to successful projects."

Despite the challenges, Saudi officials maintain that the changes represent strategic realignment rather than retreat. Kira Negron, president of the Saudi Business Council, characterizes the reported slowdown as "a considered realignment of the kingdom's approach to delivering Vision 2030." She argues that changes are intended to "simplify and clarify the path for investors by reducing reliance on intermediaries who may provide inconsistent or overpriced services."

The kingdom's priorities are clearly shifting toward delivery of specific sporting events and exhibitions. Salam notes that "the priority for PIF is headline projects, Expo 2030, and the World Cup." Saudi Arabia is set to host the Asian Winter Games in 2029, the 2034 FIFA World Cup, and Expo 2030. This consolidation is reshaping priorities and reducing opportunities for broader architectural projects.

As Bloomberg reported recently, Saudi Arabia is moving toward "less NEOM, more AI." Tellingly, the massive NEOM project didn't feature in this year's pre-budget government statement after being a headline project for three years. The same report detailed a pivot toward investing in artificial intelligence, gaming, and high-tech manufacturing. While NEOM officials deny claims of scaling back, there has been a delay in announcing architects for the vertical villages within The Line's first phase, originally due in September but now expected next year.

Nevertheless, some projects continue moving forward. Last month, the PIF unveiled a masterplan for developing Mecca and residential elements of the New Murabba downtown district in Riyadh, for which KPF recently won an international design competition. Atkins was previously revealed as the architect behind the 400-meter-wide cube-shaped building at New Murabba's center, which is currently under construction.

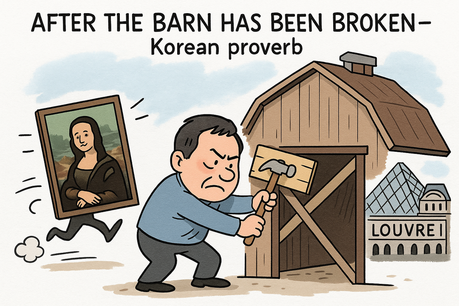

The consensus among industry professionals is that while Saudi Arabia's architectural ambitions remain substantial, the era of extraordinarily high fees for seemingly impossible projects has ended. As one architect summarized, "The feeding frenzy for UK designers is now over, and Saudi is becoming no more profitable than the UAE, Australia, or America – all of which offer better margins than UK projects." A marketing specialist whose NEOM contract wasn't renewed captured the sentiment perfectly: "It was a weird couple of lucrative years, while it lasted."