Despite decades of optimistic predictions and hundreds of millions of dollars in investment, the art world's relationship with e-commerce remains fraught with challenges. Recent developments have highlighted this ongoing struggle, as two major industry players have stepped back from significant digital initiatives amid a broader art market crisis.

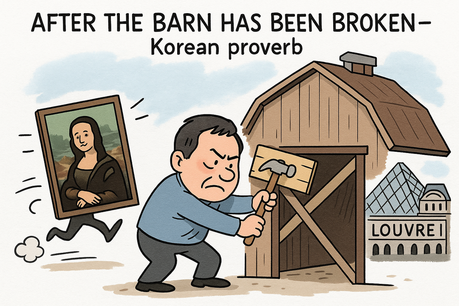

In early September, mega-gallerist David Zwirner sold his e-commerce platform to American entrepreneur Jesse Lee, founder of the design and fashion e-commerce site Basic Space. Days later, news emerged that Christie's CEO Bonnie Brennan had decided to shut down the auction house's digital art department, which was launched in 2021 to capitalize on the then-booming NFT market. Going forward, any digital works the house brings to auction will be handled by its contemporary art team.

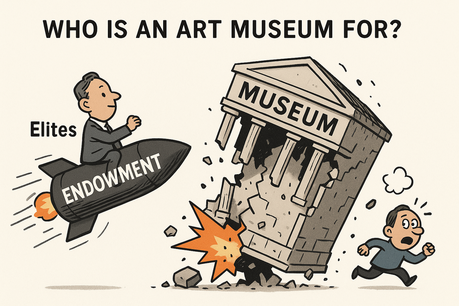

The art world has historically kept e-commerce at arm's length, fearing that new technology might disrupt its delicate ecosystem by eroding the personal relationships that have traditionally driven high-value deals. The COVID-19 pandemic appeared to change this calculus dramatically. When Art Basel became the first art fair to cancel due to the pandemic in February 2020, the organization quickly pivoted to online viewing rooms - virtual fair booths that had been in development for years but were fast-tracked when the world shut down.

Forced to embrace digital platforms, dealers who were scheduled to show at Art Basel's Hong Kong fair uploaded their works online in late March when the event was originally set to take place. For the first time, dealers even agreed to publicly reveal price ranges for every artwork, with an average of roughly $130,000 per piece - an unprecedented high for an online art platform. The art world wasn't alone in this digital pivot, as galleries, auction houses, and museums created an avalanche of new content and platforms, including an entirely new category of digital art centered on NFTs.

The underlying hypothesis driving these digital initiatives was compelling: selling digital art would attract high-rolling new collectors from the tech world who would eventually convert to buying physical pieces online, while embracing e-commerce would give traditional players a foothold in the booming NFT market. Zwirner's Platform, spearheaded by David's son Lucas and co-founder Bettina Huang, was among the most ambitious projects launched during this period. "We will never go back to the old way of working," David Zwirner told The New York Times when the project debuted. "We've encountered a much larger art world than we thought existed. If it proves to be a robust primary market, the sky's the limit."

Launching in May 2021 and structured as a freestanding startup able to work with any artist, Platform dropped 100 pieces once a month, priced between $2,500 and $50,000, taking only a 20 percent cut of sales - far below the industry's standard 50-50 split. About a year later, Christie's launched its NFT initiative, Christie's 3.0, riding momentum from the auction house's March 2021 sale of Beeple's "Everydays" NFT for an earth-shattering $69.3 million. "With this brand-driven forum, Christie's aims to recognize and bring young emerging artists to an international and digitally savvy market," the company said about its new digital art department.

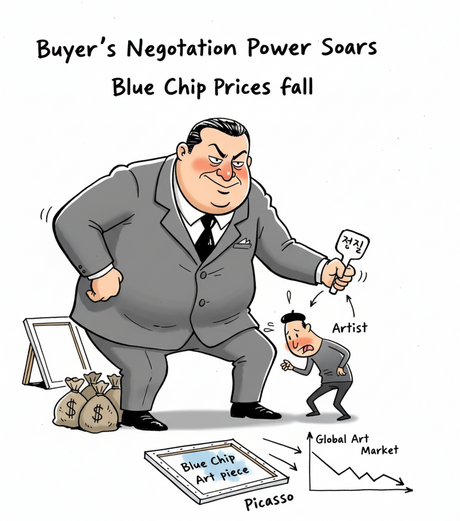

However, the anticipated hockey-stick growth never materialized. The post-pandemic years have been particularly challenging for digital sales platforms, especially within a contracting art market. The NFT art trend collapsed so spectacularly that the acronym itself is now shunned in favor of "digital art on chain." In the traditional art market, data from the 2025 Art Basel and UBS Art Market Report indicated that the portion of ultra-high-net-worth individuals buying art online fell from 19 percent in 2021 to just 6 percent in 2023.

Matt Medved, co-founder of the NFT Now platform (which has since rebranded as Now Media), broke the news about Christie's shuttering its digital arts department. "Obviously the digital art market is not in the same place as when Christie's 3.0 launched," says Medved. "During the Web3 boom, the art gallery and the casino were in the same building. Now that they're not, most of the crowds have followed the casino - and now those speculators and gamblers are off investing in memecoins."

The sale of Zwirner's Platform was more surprising to industry observers. While Platform had reportedly gone through layoffs in 2023, it had pivoted from selling less-expensive unique art to artist merchandise and lower-priced multiples from Zwirner stars such as Katherine Bernhardt, Josh Smith, Raymond Pettibon, Rose Wylie, and R. Crumb. As outgoing Platform CEO Huang points out, e-commerce is generally a difficult business, citing examples like Farfetch, Matches, and Ssense. But the art world poses unique problems.

"Good artworks try to present new ideas, so they don't fit neatly into algorithmic marketing," Huang explains. On the supply side, galleries wanting to control who gets to buy work - because the value of an artist's market can be shaped by who owns their pieces - have long resisted the "buy now" function present on most successful e-commerce sites. On the demand side, collectors expect transactions to be straightforward because buying everything else online has become so streamlined. "People are no longer as willing to jump through hoops to buy art," Huang notes.

At a more fundamental level, there's the question of whether legacy power players with significant assets to protect and high operational costs are the right entities to launch digital initiatives. Perhaps it never made sense for 259-year-old Christie's, with its complex hierarchies and dozens of offices worldwide, to enter an NFT market driven by Discord channels, where artworks were typically held for weeks rather than years. "Christie's had the most advanced platform from a legacy player, but it's tough for a company that big to keep up with fast-moving trends," observes Medved. "Plus, it was seen as a way to attract crypto-native wealth toward collecting paintings and sculpture on the legacy side. That didn't play out as much as expected."

The reality is that e-commerce isn't necessary to sell a $250,000 painting - the number of potential buyers is too small, and the deals are too personality-driven. Digital's sweet spot lies further down the market pyramid, where dealers must sell thousands of works to hundreds of collectors to make the model worthwhile. Zwirner and his fellow investors reportedly invested $10 million into Platform. While that's substantial money in the art world - enough to poach a star artist - it's bare bones in the tech startup world, where the "grow first, monetize later" mindset requires massive burn rates.

Jesse Lee of Basic Space plans to take a different approach to making the acquired platform work. "We'll probably move the artist collaborations to the Basic Space site, and we want to move the Basic Space customer base toward art," Lee says. "These are real people that we already sell to, and I can see many of them graduating from buying fashion to buying art." Lee is keeping Huang and the Zwirners on board as advisors to ensure quality control.

Recognizing that the market's relatively small size demands high audience engagement to succeed, Lee - who also bought the Design Miami fair franchise in 2023 - plans to heavily emphasize hybrid promotional strategies. "We're going to over-index on events, because we see that online activity jumps and more sales happen whenever we do things in real life," Lee explains. "We need to create compelling experiences with art, so we can bring new people into the community. But we also need galleries to adapt. To a smart, cool 25-year-old with money to spend, a sales platform with missing prices just seems crazy."

The bottom line remains clear: NFTs have largely failed to maintain their initial momentum, e-commerce is inherently challenging, and e-commerce for art is even more difficult. Legacy players should perhaps stay out of the startup game, and digital sales will never dominate the art market's upper tier. However, there remains scope for selling art merchandise, multiples, and five-figure works by emerging artists online - provided the approach is realistic about the market's limitations and opportunities.