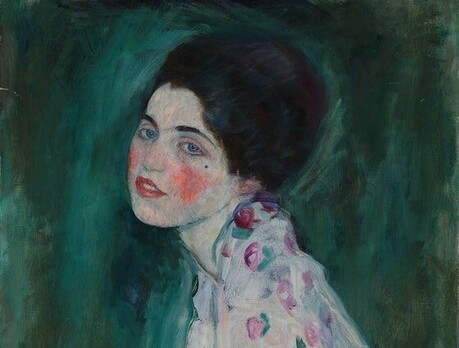

A repeat art fraudster has been arrested by the FBI for stealing a valuable 1844 Gustave Courbet painting through an elaborate scheme that fooled a London gallery owner and involved multiple accomplices. The case highlights the importance of thorough background checks in high-value art transactions and exposes vulnerabilities in the art market's verification processes.

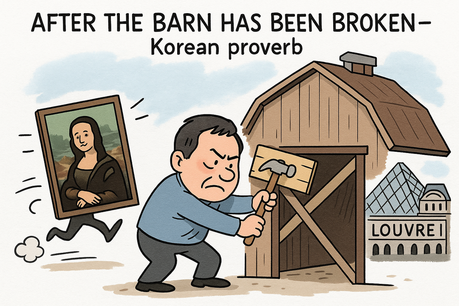

Know-your-client rules in art transactions can make the difference between identifying a fraudster and losing possession of valuable artwork. London gallery owner Patrick Matthiesen learned this lesson the hard way when he fell victim to an elaborate fraud involving his 1844 Courbet oil painting "Mother and Child on a Hammock." Matthiesen had purchased the work at a French auction house in 2015 and later consigned it to the Nicholas Hall Gallery in New York, which specializes in Old Master works, to display at the 2023 Tefaf Maastricht fair with a listing price of $650,000.

The painting didn't sell at the fair, but the Nicholas Hall Gallery expressed interest in displaying it in New York. However, events took an unexpected turn when Matthiesen was contacted by Thomas Doyle, a man who would prove to be a career criminal. "I was introduced to a Thomas Doyle, whom I never had heard of and who just appeared out of the woodwork through an email," Matthiesen told The Art Newspaper. Doyle presented himself as a U.S. Air Force member and "Top Gun," claiming to be a government contractor who also dealt in art.

Doyle spun an elaborate backstory to establish credibility, saying his mother was involved in the art world and making references to the prominent Doyle Auctions house. He claimed his family had a substantial trust that invested in art, though he had been cut out of it for unspecified reasons while still maintaining access to important artworks. These claims were designed to explain how he could have access to valuable pieces without direct ownership.

Matthiesen conducted some background research on Doyle, who used the name A.J. Doyle rather than Thomas Doyle in their communications. This name variation proved significant, as Thomas Doyle had 11 convictions for fraud, while A.J. Doyle had no known criminal record. When Matthiesen contacted people at leading auction houses, they confirmed there was indeed a Doyle family in the art world, lending apparent credibility to the fraudster's claims. One of Thomas Doyle's previous convictions was for stealing a bronze Edgar Degas statue of a dancer in 2007, for which he served two years in prison.

"It all appears to be a bit casual," commented Julian Radcliffe, chairman of the London-based Art Loss Register, which tracks stolen works of art. Despite red flags, Matthiesen became convinced of Doyle's legitimacy based on actual artworks the fraudster sent for examination. These included two El Greco paintings ("not in good enough condition for me to want to handle," Matthiesen recalled), a Peter Paul Rubens work, and a drawing Doyle claimed was by Michelangelo. "Very beautiful, but I believed, and I had confirmation of this by a curator at the Metropolitan Museum of Art, that it actually had been drawn by one of Michelangelo's assistants," Matthiesen explained. The London dealer was nonetheless impressed, saying, "I believed in the man, because he produced real things."

In 2024, Doyle offered to partner with Matthiesen in selling a painting by Jean Baptiste-Camille Corot, but the dealer was cautious due to the prevalence of fake Corots in the market. Unknown to Matthiesen, Doyle had been sued and arrested in 2010 for allegedly attempting to arrange a fraudulent purchase of a Corot painting. Doyle had pleaded guilty to one count of wire fraud and was sentenced to six years in prison. At his sentencing, according to The New York Times, the judge told Doyle: "You are a career criminal by any definition of the term."

The actual theft occurred when Doyle claimed he knew of a buyer for the Courbet and asked Matthiesen if he could borrow the painting to show this potential purchaser, promising to broker a sale. Remarkably, without ever meeting Doyle in person, Matthiesen agreed to send him the valuable artwork. "Patrick asked us to release it to Mr. Doyle, which we did," confirmed Nicholas Hall. "It was in fact picked up by a representative for Doyle," Hall added, noting that "Patrick subsequently told me that Mr. Doyle had indeed sold it for him." Matthiesen never saw the painting again.

Matthiesen described Doyle as "a kind of Walter Mitty," referring to the James Thurber character who claims expertise in areas he only dreams of, calling him "very convincing." Doyle told Matthiesen that his unnamed buyer was willing to pay $550,000 for the Courbet, an amount the London dealer found acceptable. However, Doyle had a partner in this scheme: dealer Shalva Sarukhanishvili, who took charge of actually selling the painting.

Sarukhanishvili sold the Courbet to the Jill Newhouse Gallery in New York City for $115,000, significantly less than the agreed-upon price. The Newhouse Gallery then promptly resold the work to noted art collector and Bruce Springsteen business manager Jon Landau for $125,000. For both transactions, the sellers provided false provenance documentation indicating that Doyle had been the painting's legitimate owner, concealing the fact that it had been stolen from Matthiesen.

No money was ever transferred to the Matthiesen Gallery despite the supposed sale. In an email dated March 4, 2025, Doyle acknowledged to the London dealer that he had been "lied to," recommending that Matthiesen contact Sarukhanishvili to either recover the painting or receive payment. When Matthiesen attempted to contact Sarukhanishvili, he received no response, making it clear that he had been the victim of an elaborate fraud.

On November 14, the 68-year-old Doyle was arrested by agents from the FBI's Art Crime Team and charged with one count of wire fraud, which carries a maximum prison term of 20 years. The case is being handled by the Office's Illicit Finance and Money Laundering Unit, reflecting the serious nature of the charges. Sarukhanishvili is also being sought by law enforcement agents as investigators work to unravel the full extent of the criminal enterprise.

A civil lawsuit filed in late September in a New York district court by Matthiesen seeks to recover either the painting or its value. The suit names Doyle, Sarukhanishvili, the Jill Newhouse Gallery, and Landau as defendants. Matthiesen claims that none of the first three defendants had the legal right to consign or sell the Courbet. The complaint alleges that Newhouse, "an active participant in the art market," knew or should have known that Matthiesen had been offering the painting for $650,000 or more for several years.

Regarding Landau, the lawsuit claims he "knew or should have known that Newhouse lacked the ability to pass good title to the Painting, because Landau previously viewed the painting multiple times at multiple locations other than with Newhouse. Each time he was aware that its retail price was $650,000 or more." Steven Schindler, a New York City lawyer representing Matthiesen, argued that both Newhouse and Landau should have recognized the deal was "too good to be true." He claimed that "a reasonable amount of research" would have revealed problems with the sale, though he added, "I've certainly seen people do less due diligence in the art trade."

The legal battle continues as the parties dispute ownership and responsibility. Jill Newhouse and her lawyer, Amelia K. Brankov, declined to comment while the case remains ongoing. However, Jonathan Kraut, a lawyer representing Landau, stated firmly: "Based on applicable law, Jon Landau is the rightful owner of that painting." The lawsuit seeks either the return of the painting to Matthiesen or compensation equal to the work's value, placed at $550,000.

This case has broader implications for the art market's security and verification processes. Julian Radcliffe draws an important lesson from this episode, arguing that "the art world needs a database of people who have defrauded someone, who have not paid their debts or should not be traded with." He believes such a database "would be a major deterrent to these kinds of crimes, getting the art trade closer to the standards of other industries, like banking and insurance." The incident underscores the need for more rigorous due diligence procedures in high-value art transactions to prevent similar frauds in the future.