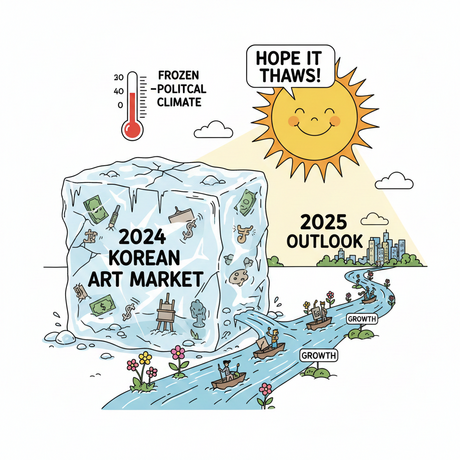

The art market's relationship with inflation has become increasingly complex as global economies continue to grapple with rising prices across various sectors. While art has historically been viewed as a hedge against inflation, the reality is more nuanced, with artworks themselves subject to inflationary pressures that affect everything from production costs to shipping expenses.

Inflation represents the rate at which prices for goods and services increase over time, occurring when production costs rise or when demand exceeds an economy's ability to supply additional goods and services. Since the COVID-19 pandemic, economies worldwide have faced significant inflationary challenges. In the United States, inflation peaked at 9.2% year-over-year in June 2022 before moderating to 2.7% by June of this year. These economic pressures inevitably impact consumer behavior across all industries, including the art world.

"The macroeconomic position inevitably impacts people's decisions about art," explains Simon Oldfield, a curator, art dealer, and lawyer. "We're all connected to the wider picture, including inflationary pressures, and we don't leave those thoughts and concerns at the door when it comes to art." This connection between broader economic conditions and art market dynamics reflects the multifaceted nature of art as both a cultural commodity and financial asset.

Art has gained recognition as an inflation hedge primarily due to its historical price stability compared to traditional securities or cash holdings. Unlike fungible assets that can lose purchasing power during inflationary periods, each artwork represents a unique, non-fungible object whose value depends on factors such as artistic quality, rarity, taste, and the artist's reputation. This uniqueness sets art apart from other major asset classes and contributes to its perceived stability during economic uncertainty.

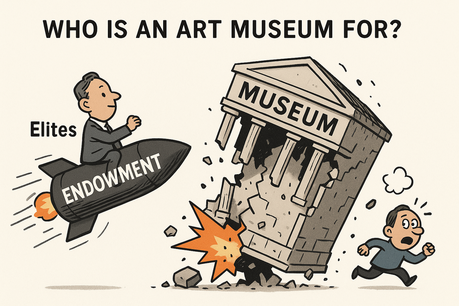

Director Boll, deputy chairman of 20th and 21st Century Art at Christie's, emphasizes that an artwork's price stability correlates directly with its perceived artistic quality. "Even when prices go down, prices go down last and least for artwork of the highest quality," he notes. However, he raises important questions about who defines quality and how much quality assessment now derives from public opinion and community consensus rather than traditional art critics and institutional authorities.

During pre-sale estimations at Christie's, Boll observes that sellers often arrive with specific pricing expectations based on their original purchase price, buyer's premiums, import costs, and exchange rate fluctuations. "Sadly, the present value of a piece is not influenced by what was previously paid," Boll explains. "The value of art follows other criteria, not financial historical data." This disconnect between historical costs and current market value reflects art's unique position in the broader economy.

The motivations behind art purchases also distinguish this market from traditional investment sectors. "Behind every work of art, there is a creator, and most collectors are respectful of their relationship with the artist and aren't in it to make a quick buck," Oldfield observes. This emotional and cultural connection between collectors and artists creates market dynamics that often transcend purely financial considerations.

Despite art's reputation as an inflation hedge, artworks themselves face significant inflationary pressures across multiple aspects of the market ecosystem. The costs associated with creating, exhibiting, insuring, transporting, and selling art increase alongside general inflation, and these higher expenses are typically passed on to buyers. This creates price pressures that affect both primary markets (where artists first sell their work) and secondary markets (where previously owned works are resold).

Mario Zonias, co-founder of Maddox Gallery, identifies rising material and production costs as serious challenges for contemporary artists. "These pressures have grown steadily over the past two years, and tend to hit emerging artists the hardest," he explains. Emerging artists often lack the financial resources and market recognition to absorb increased costs, making them particularly vulnerable to inflationary pressures that established artists might more easily navigate.

Shipping costs represent another significant inflationary pressure point in the global art market. Bianca Bonifacio, art investment associate at Anthea Art Investments, notes that "in the last two years, we have seen an increase in the cost of shipping, which has an impact on the global market." However, the relative impact of shipping costs varies dramatically based on artwork value. For lower-value pieces, shipping fees can represent a substantial proportion of the work's total value, while they become relatively insignificant for seven-figure artworks.

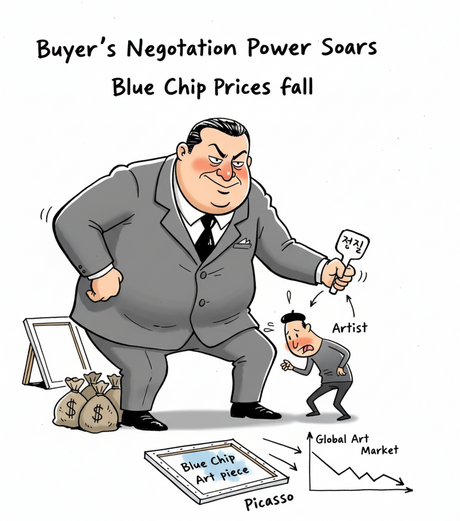

At the market's highest levels, individual collector circumstances often outweigh broader macroeconomic factors in purchasing decisions. Art advisor David Shapiro explains that "prices may be up, but if money coming in is also up, that doesn't necessarily mean a downturn in art purchasing for some." He notes that collectors interested in works by masters like Pablo Picasso are typically less influenced by daily inflation concerns and routine cost increases, as their purchasing power often grows alongside or faster than inflation rates.

The art market has experienced its own periods of dramatic price inflation, particularly following the COVID-19 pandemic from 2021 to 2023. During this period, factors including fiscal stimulus measures and pent-up consumer demand caused certain artwork prices to reach unprecedented levels. Many artists witnessed their work values climb to extreme highs within months, creating market conditions that proved unsustainable for some segments.

Arushi Kapoor, an art advisor and founder of The Agency Art House, reflects on this period: "Even though inflation then was not as high as it is now, the value of [some] artists' work achieved unreasonable highs in record time, and fell just as quickly afterwards." This volatility demonstrates that while art may serve as an inflation hedge over long periods, it remains subject to market speculation and rapid price fluctuations that can create significant risks for investors.

The sudden and often aggressive price spikes during the post-pandemic period highlighted the difference between sustainable market growth and speculative bubbles within the art world. Some artists and their representatives found themselves navigating unprecedented demand that artificially inflated prices beyond levels that could be maintained as market conditions normalized.

Despite inflation's clear impact on art market demand and pricing structures, market forces have limitations in an industry where purchasing decisions involve substantial emotional and cultural factors beyond pure financial calculation. The art world operates according to principles that often transcend traditional economic models, creating unique market dynamics that resist purely quantitative analysis.

"People don't make art because the economy is good, they make art because they are artists," Oldfield emphasizes. "Collectors buy art because they need it in their lives." This fundamental truth about artistic creation and collection suggests that while economic factors certainly influence the art market, they cannot fully explain or predict its behavior. The intersection of cultural value, personal meaning, and financial considerations creates a market environment that remains partially insulated from broader economic trends while still responding to macroeconomic pressures in measurable ways.