The worldwide success of "K-Pop Demon Hunters," an animated film that premiered on Netflix in June, has delivered an unexpected surge to Korea's soft power influence. This unique production, featuring a fictional K-pop girl group that fights demons using music-infused supernatural abilities, has dominated streaming charts across more than 30 countries and pushed its soundtrack to an impressive second place on the Billboard 200.

However, what proves more significant than the film's entertainment success is what it has exposed about Korea's export capabilities and the obstacles that limit them. While enthusiastic fans spanning from Singapore to the Netherlands rushed to purchase Korean merchandise connected to the movie's characters – ranging from folk-art-inspired souvenirs to traditional Korean accessories – the actual buying experience was far from seamless.

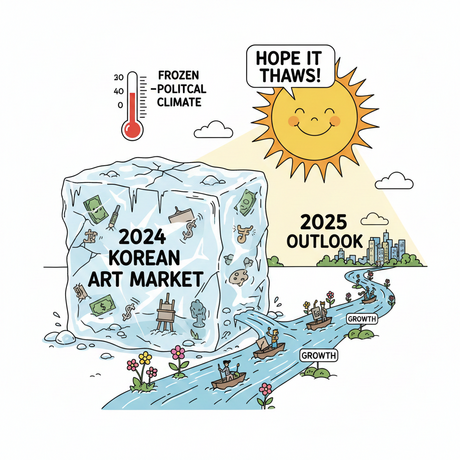

Despite Korean cultural products now wielding tremendous emotional appeal on a global scale, the infrastructure enabling overseas consumers to access Korean products, particularly through digital commerce platforms, remains surprisingly inadequate. Data from the Bank of Korea reveals that South Korea's cross-border e-commerce exports to individual international consumers – commonly known in Korea as "reverse direct purchases" or "yeok-jikgu" – reached only 1.6 trillion won ($1.1 billion) in the previous year. This figure represents merely one-fifth of the volume generated by inbound direct purchases made by Korean consumers from international retailers.

These statistics demonstrate that Korea's e-commerce platforms have consistently failed to capitalize on foreign demand, even as Korean entertainment, beauty products, and food continue to surge in global popularity. A significant portion of this problem stems from unnecessary procedural obstacles that create barriers for international customers.

Most domestic Korean platforms continue to require identity verification through Korea-registered mobile phone numbers, despite no legal requirements mandating this practice. International consumers, regardless of their motivation to make purchases, are routinely blocked during the initial sign-up process. Those fortunate enough to overcome that initial hurdle often encounter another significant obstacle at checkout, where many Korean websites refuse to accept international payment methods such as Visa, Mastercard, PayPal, or Alipay.

The outcome is an extremely restrictive system that effectively drives away eager customers who are ready and willing to spend money on Korean products. This stands in stark contrast to major international platforms like Amazon, AliExpress, and Temu, which allow foreign users to register and complete payments with minimal friction or complications. These companies conduct their own verification processes using standard credit card information or globally recognized digital wallets, thereby reducing entry barriers while managing fraud risks through internal systems.

Chinese e-commerce platforms operating within South Korea have even successfully integrated domestic payment systems such as Naver Pay to better serve local customers and localize their offerings. Yet Korean platforms have shown reluctance to reciprocate these efforts, even as global demand for Korean goods continues to climb steadily.

This hesitation reflects both inflexible regulatory constraints and an outdated corporate culture characterized by excessive risk aversion, particularly concerning identity theft, fraudulent transactions, and payment disputes. However, technological solutions to address these concerns already exist and are readily available.

Practical steps that Korean retailers can implement immediately include integrating payment systems that are popular and trusted in their target international markets, adopting more user-friendly authentication procedures that don't exclude foreign customers, and expanding their overseas fulfillment and shipping capabilities to serve international demand more effectively.

The Korean government and regulatory bodies have a crucial role to play in addressing these systemic issues. The Bank of Korea's recent recommendations – which include simplifying account verification processes, providing clear legal guidance around non-Korean user registrations, and actively embracing global payment tools and platforms – represent a necessary and important starting point for reform.

More broadly, South Korea's failure to liberalize and modernize its e-commerce model may significantly deepen the existing structural imbalance in digital trade relationships. As global commerce increasingly revolves around digital platforms rather than traditional physical intermediaries, the country simply cannot afford to remain digitally isolated from international markets.

Ironically, the core appeal of "K-Pop Demon Hunters" – its seamless fusion of traditional Korean cultural motifs with contemporary music styles and vibrant animation – perfectly highlights what South Korea excels at: successfully marrying cultural heritage with innovation in ways that resonate powerfully with global audiences. However, transforming this cultural capital into tangible economic returns will require an equally imaginative and comprehensive overhaul of Korea's digital marketplace infrastructure.

Nearly a decade has passed since the so-called "Cheon Song-yi coat" phenomenon, when a Korean television drama ignited massive global fashion interest and prompted widespread calls for easier reverse purchase options for international consumers. Despite this clear demand signal, progress has been disappointingly limited. The nation's major e-commerce platforms continue to operate largely as if their only customers are domestic Korean consumers.

This outdated approach must change immediately. With unprecedented global attention now focused on Korean products across multiple categories – from beauty and fashion to food and entertainment – the very least the country can do is avoid creating unnecessary barriers that shut the door on K-culture's remarkable global rise. Korean businesses and policymakers must recognize that the current moment represents a unique opportunity to capitalize on the country's cultural influence, but only if they remove the digital obstacles that currently prevent willing international customers from accessing and purchasing Korean products.